Cost Segregation Study

Cost Segregation overview

Engineering-Appraisal-Based | IRS-Defensible | Institutionally Aligned

Cost segregation is a capital recovery strategy that reclassifies qualifying components of real property into shorter tax recovery lives, accelerating depreciation and improving early-period cash flow.

But cost segregation is not merely a tax exercise.

With us, cost segregation is practiced as a discipline of valuation economics and engineering-based asset classification, designed for assets where capital intensity, system complexity, and regulatory scrutiny materially affect recoverability.

We do not approach cost segregation as a template-driven reclassification service.

We approach it as capital recovery under uncertainty.

Cost Segregation as a Capital Recovery Discipline

In capital-intensive assets, depreciation outcomes are not driven by square footage — they are driven by:

- How systems are engineered

- How capital is deployed

- How assets are economically consumed

- How infrastructure supports production, power, and operations

Cost segregation, when properly executed, aligns tax recovery with economic reality, not architectural form.

This is particularly critical for:

- Infrastructure assets

- Power-intensive facilities

- Industrial and production-driven properties

- Data centers and energy systems

- Specialized commercial real estate

Our Engineering + Appraisal-Based Approach

Unlike generic or software-driven studies, our engagements integrate:

Engineering-Based Asset Identification

We analyze how systems are designed, installed, and function within the asset, including:

- Electrical and mechanical systems

- Process and production infrastructure

- Structural supports tied to equipment and systems

- Utility, power, and control architectures

Assets are classified based on economic function, not visual appearance or generic categories.

Appraisal-Based Capital Allocation

We apply appraisal discipline to:

- Reconstruct total project basis

- Abstract non-depreciable land using market and residual methods

- Reconcile all allocations internally

- Prevent distortions caused by improper shell or land allocation

This ensures depreciation outcomes reflect capital reality, not aggressive modeling.

IRS-Defensible, Audit-Ready by Design

Our studies are structured to withstand:

- IRS examination

- CPA and auditor review

- Transactional due diligence

- Institutional governance standards

Every engagement emphasizes:

- Transparent asset classification logic

- Engineering support for functional assignments

- Full reconciliation to total project cost

- Conservative interpretation aligned with IRS guidance

- Documentation suitable for Form 3115 and related filings

Acceleration is pursued only when supported by function, documentation, and law.

Bonus Depreciation: Why Methodology Matters More Than Ever

Recent federal legislation restored 100% bonus depreciation for qualifying property placed in service on or after January 20, 2025.

This allows qualifying 5-, 7-, and 15-year property to be fully expensed in Year 1 — for both new and used assets.

However, bonus depreciation is only as valuable as the quality of the underlying asset classification.

Template-based or aggressive studies can:

- Misclassify long-life property

- Over-allocate to qualifying classes

- Create IRS exposure

- Undermine audit defensibility

Our methodology ensures bonus depreciation is:

- Applied conservatively

- Technically supported

- Institutionally defensible

Cost Segregation by Asset Class

Our cost segregation practice is structured around infrastructure and capital intensity, not generic property categories:

Industrial & Manufacturing

Process-driven facilities with high utility and equipment integration

👉 [Industrial Cost Segregation]

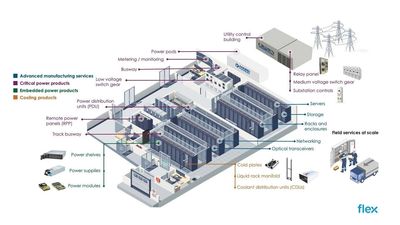

Data Centers

Power-dense, mission-critical infrastructure platforms

👉 [Data Center Cost Segregation]

Energy & Power Infrastructure

Nuclear, renewable energy, and power generation assets

👉 [Energy & Power Infrastructure Cost Segregation]

Commercial & Hospitality

Office, hotels, retail, mixed-use — executed with institutional discipline

👉 [Commercial & Hospitality Cost Segregation]

When Cost Segregation Is Most Valuable

- Upon placement in service

- At acquisition or recapitalization

- After expansion, retooling, or retrofit

- For multi-phase or campus-scale developments

- In connection with valuation, financing, or tax planning events

Bottom Line

Cost segregation, when properly executed, is not a tax strategy — it is a capital recovery discipline.

At US Valuation, cost segregation is:

- Engineering-informed

- Appraisal-disciplined

- IRS-defensible

- Designed for audit and institutional scrutiny

- Aligned with how infrastructure and commercial assets actually function

Begin with a Preliminary Review

We offer a no-fee preliminary feasibility discussion to assess whether a full study is appropriate and economically justified for your asset.

👉 Request a Preliminary Cost Segregation Review

Copyright © 2018 CostSegregationExpert.com - All Rights Reserved. Serving Nationwide — Engineering-Based and Appraisal-Based Cost Segregation Studies for Infrastructures (Data Centers, Power & Nuclear Assets) and Commercial, Industrial, Manufacturing, and Multifamily Assets. Certified General Real Estate Appraiser in States of CA, NV, TX, OR, WA, AZ, HI, GA, VA, DC, MD.

David Hahn, CVA, ASA, MAFF, CCIM, CM&AA, MBA

CVA - Certified Business Valuation Analyst --- (IRS Tax Valuation Expert)

ASA - Accredited Senior Appraiser

CCIM - Certified Commercial Investment Member

CM&AA - Certified Merger & Acquisition Advisor

MAFF - Master Analyst in Financial Forensics

State Certified General RE Appraiser in California, Arizona, Nevada